personal property tax car richmond va

The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231. Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD.

5805 River Rd Richmond Va 23226 Realtor Com

My office has used the same assessment.

. Ad Browse Legal Forms by Category Fill Out E-Sign Share It Online. Henrico VA 23273-0775 Contact by Phone Main 804 501-4000 Fire Police and Rescue 911 24 hours Police non-emergency 804 501-5000 24 hours Mental Health Emergency Services. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. Currently the personal property tax rate in the city is 370 per 100 of assessed value for passenger vehicles boats farming equipment and trucks with a gross vehicle weight. An example provided by the City of Richmond goes like this.

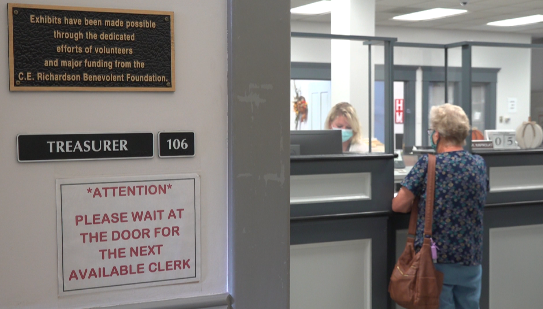

All online in person or mail payments madepostmarked on or before August 5 2022 will not be subject to penalties or interest. Find All The Record Information You Need Here. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

At the calculated PPTRA rate of 30 you. WWBT - If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of.

If your vehicle is valued at 18030 the total tax would be 667. Please visit RVAgov to pay online. Unsure Of The Value Of Your Property.

Ad One Simple Search Gets You a Comprehensive Richmond Property Report. WRIC -- Governor Glenn Younkin signed House Bill 1239 into law today which empowers localities to cut tax rates on cars and to prevent tax hikes from the rise. Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the. If you can answer YES to any of the following questions your vehicle is considered by.

The Best Cheap Richmond Homeowners Insurance In 2022 Moneygeek Com

Junk Car Removal R R Towing Richmond Va 804 745 8697

3115 Grove Ave Richmond Va 23221 Zillow

The Boulder S Office Park Boulders Ii 7400 Beaufont Springs Drive Richmond Va Office Building

2314 Buckingham Ave Richmond Va 23228 Mls 2215991 Redfin

Costar Group Announces Plans For Expanded Corporate Campus In Richmond Virginia Business Wire

4206 W Franklin St Richmond Va 23221 Realtor Com

Diamond Inn And Suites In Richmond Va Expedia

Junk Car Removal R R Towing Richmond Va 804 745 8697

Vehicle Supply And Demand May Lead To Higher Personal Property Taxes In Virginia

13294 Beckford Ln Richmond Va 23238 Realtor Com

1230 Warren Ave Richmond Va 23227 Mls 2122045 Zillow

4206 W Franklin St Richmond Va 23221 Realtor Com

6425 Richmond Hwy 301 Alexandria Va 22306 Mls Vafx2005136 Redfin

1010 N Belmont Ave Richmond Va 23221 Zillow

410 Seneca Rd Richmond Va 23226 Realtor Com

Vehicle Supply And Demand May Lead To Higher Personal Property Taxes In Virginia